Our takeaways from the WASIC Conference

As the dust settles on the first ever Water and Sanitation Investment Conference (WASIC) held from 6 – 8 March 2024 in Nairobi, Kenya, we take a moment to reflect on the insights.

The overarching theme of the conference was “Accelerating Investments for Sustainable Access to Water and Sanitation for All” and its aim was to promote open discourse and build partnerships towards financing sustainable access to water and sanitation services for all Kenyans by 2030.

Highlights from the conference:

- The Government of Kenya (GoK) has set water supply and sanitation sector goals as presented in the National Water and Sanitation Investment and Financing Plan (NAWASIP), an ambitious 7-year plan aiming at mobilising up to €7 billion required to achieve universal coverage by 2030. 40% of this financing is expected to come from the private sector, through Public Private Partnerships (PPPs), and commercial bank loans.

- There seems to be political goodwill to unlock private sector investments. The Government of Kenya highlighted recent policy reforms aimed at creating a conducive policy and regulatory framework for private investments. These include the new PPP Act (2021) which clarified investment contracting models and processes for PPPs.

- Beyond policy reforms and political goodwill, blended finance solutions need to be encouraged to accelerate investments. Risk funds are critical to support investment readiness of projects and enterprises, while Capex subsidies (and patient capital) are essential to improve risk/return profiles of investment projects.

- Most sector development initiatives included a component of crowding in private investment/ commercial finance. “Results Based Finance” was heavily promoted at various side events.

- The private sector’s innovations illuminated the opportunities for utilities regarding technological adaptability and data-driven decision-making, even in the face of climate change issues. Our partner Smart People Africa showcased its recently introduced Maji bytes ERP for small water providers and community schemes. This technology, funded by Aqua for All, not only enables most rural water operators to run their operations effectively without large capital expenditure, but also to assess, interpret, and communicate their business performance to a financier.

Our participation

In collaboration with our partners Smart People Africa, Nazava, National Bank, Sidian Bank, Family Bank, and Cooperative Bank, we demonstrated how blended financing structures can effectively crowd in much-needed resources to close Kenya’s existing financing gap. As of 2023, Aqua for All and its partner banks have committed €40 million to support the GoK in achieving universal coverage.

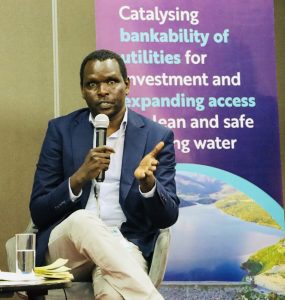

- Joshua Kibet, our WASH Finance Lead East Africa, emphasised the significance of integrating technical support, data and derisking mechanisms to unlock commercial finance for infrastructure projects in the session “Building Bankability of Water Utilities for Sustainable Investments” convened by Gatsby Trust. His insights were drawn from the Challenge Fund programme we launched in Kenya last year.

- In his keynote speech, George Odhiambo, Managing Director of the National Bank of Kenya, stressed the fundamentals of a bankable organisation, including having a legal entity, meeting compliance needs based on local laws, establishing clear governance, having an addressable market, and developing a connection with the bank. The Challenge Fund Programme aims to address these fundamental issues, with a focus on small, piped water projects.

- Shadrack Odhiambo, WASH Relationship Manager at Family Bank, underlines the necessity of development partners using locally customized de-risking methods, focusing on Aqua for All’s First Loss Guarantee mechanism and results-based subsidies for modest infrastructure projects. Mwanzia Kasalu, WASH Relationship Manager, Cooperative Bank, stressed that political/or public sector risks present a key barrier to commercial finance, coupled with low creditworthiness of utilities.

- John Patrick, Head of SME at Sidian Bank, laid out considerations for banks regarding sanitation financing, and stressed the important role that development partners play in ecosystem development and de-risking lending to the sub-sector.

- Lieselotte Heederik, Founder and CEO of Nazava shared her experience in setting up a social business and provided insights on the right capital structure for a sustainable and investable enterprise.

- Tony Chumba, Head of Research and Development at Smart People Africa showcased the FundMyWater platform, a digital platform enabling stakeholders to identify, prepare and finance projects. The platform includes more than 30 projects at various stages of development and appraisal for financing.

What we take forward

With delegates from the public and private sector and development corporations we reflected on sector challenges and innovative ways to respond with innovative solutions and financial mechanisms:

1. Non-Revenue Water (NRW) investments in Kenya: Water losses were identified as the single most significant barrier to Kenyan water utilities being creditworthy. Some utilities lose up to 70% of their supply, while the industry average is 45%, resulting in revenue leakage of about € 740 million per year. This is huge, but it also presents investment opportunities.

2. Collaborations to scale investments in Rural Water: Rural water continues to lag in terms of investment, with small, piped schemes largely under/unfunded.

3. National Platform to Crowd in Private Funders. We discussed the need for strategic platforms for alternative funders with policy makers – philanthropies, corporate foundations, social investors to engage with Government on alternative investment models in the WASH sector. We need a new roadmap to meet our goals for the sector by 2030…